does indiana have estate or inheritance tax

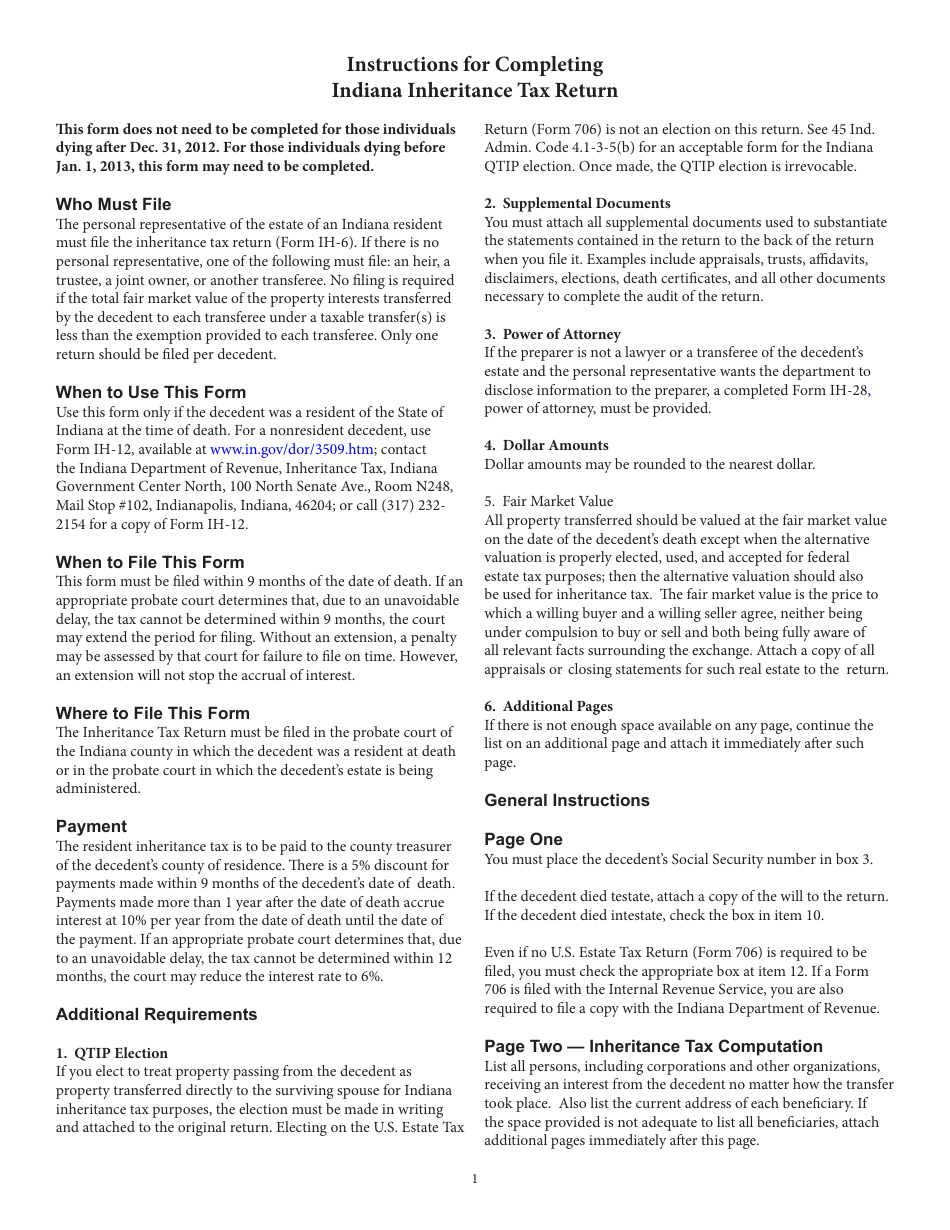

You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

2021 Estate Income Tax Calculator Rates

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

. How to get a Tax ID Number for a Trust or Estate in Hamilton County IN. In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. Tennessee repealed its estate tax confusingly called an inheritance tax by the state this year the culmination of a multi-year phase-out and Indiana completed the repeal of its inheritance tax in 2013.

Just five states apply an inheritance tax. There are 12 states that have an estate tax. Impose estate taxes and six impose inheritance taxes.

There is no inheritance tax in Indiana either. Indiana Inheritance and Gift Tax. In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013.

If you are curious about the six states that impose state-level estate taxes they are New Jersey Nebraska Iowa Kentucky Pennsylvania and Nebraska. We had an inheritance tax in Indiana but it was repealed. For individuals dying before January 1 2013.

Utah residents do not need to worry about a state estate or inheritance tax. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax. There is no federal inheritance tax but there are a handful of states that impose state-level inheritance taxes.

The tax is not applicable if the decedent passed away after December 31st of 2012. However other states inheritance laws may apply to you if. Below we detail how the estate of Indiana will handle your estate if theres a valid will as well as who is entitled to your property if you have an invalid will or none at all.

Are required to file an inheritance tax return Form IH-6 with the appropriate probate court if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. Indianas inheritance tax still applies. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes.

It doesnt matter how large the entire estate is. Indiana does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. State Capital Gains Taxes in Indiana.

Therefore no inheritance tax returns must be filed at this time. In Indiana there are several ways that estate administration can be handled depending on the level of supervision required and the amount of assets in the estate. Indiana repealed the estate or inheritance tax for all those who die after December 31 2012.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. The transfer of a deceased individuals ownership interests in property including real estate and personal property may result in the imposition of inheritance tax. What Taxes Need to Be Filed After Someone Dies.

In general estates or beneficiaries of. The tax is imposed on the recipient of the inheritance but many estate planning documents provide for the payment of the inheritance tax out of the decedents estate before assets are distributed. Inheritance tax applies to assets after they are passed on to a persons heirs.

Even though Indiana does not collect an inheritance tax however you could end up paying inheritance tax to another state. The tax rate is based on the relationship of the inheritor to the deceased person. Below we detail how the estate of Indiana will handle your estate if theres a valid will as well as who is entitled to your property if you have an invalid will or none at all.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. There is an 1170 million exemption for the federal estate tax in 2021 which increase to 1206 The exemption is portable for married couples. Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island.

Just because you dont have an estate tax at the Indiana level you could find that you have it. Indiana has a very tax friendly state. Utah does have an inheritance tax but it is what is known as a pick-up tax.

Maryland is the only state to impose both. Indiana repealed the inheritance tax in 2013. Does Indiana Have Estate or Inheritance Tax.

New Jersey Nebraska Iowa Kentucky and Pennsylvania. At the present time there are only six states that still have inheritance taxes. In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary.

Even though there is a state tax assessment there is no inheritance tax estate tax or gift tax. While Federal Estate Tax is assessed on a decedents total combined asset value Indiana Inheritance Tax is a transfer tax assessed on each separate transfer. What Indiana Residents Need to Know About Capital Gains Taxes.

Even though Indiana does not collect an inheritance tax however you could end up paying inheritance tax to another state. Unlike neighboring Wisconsin Michigan Indiana and Missouri Illinois is one of just a dozen states that still have an estate or inheritance tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Twelve states and Washington DC. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax.

There is also a tax called the inheritance tax. Residents of New Jersey and Maryland have to contend with a state-level estate tax and a state-level inheritance tax in. Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state.

Utah does not have a state inheritance or estate tax. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes. But make sure you do your tax planning.

And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. New York are in the process of phasing in new higher estate tax exemptions eventually matching the federal exemption level 59 million by 2019. Tax Foundation analyst Katherine Loughead noted The top marginal estate tax rate under this proposal would become the highest in the country at 21.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Calculating Inheritance Tax Laws Com

Indiana Inheritance Laws What You Should Know Smartasset

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Indiana Estate Tax Everything You Need To Know Smartasset

Illinois Is One Of Few States With Death Tax Bill Would Double It Madison St Clair Record

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Indiana Inheritance Laws Tips To Keep Wealth In The Family

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

Indiana Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die